Private Sector

Sailing Into Troubled Waters

Dutch Marine Engineer, Cornelius Van der Horst was the Repair and Technical Manager of Petroleum Shipping Ltd, a subsidiary of Exxon Corporation. Van der Horst oversees the maintenance and repair of Exxon’s tankers worldwide, including managing the tenders for contracts and making recommendations to his senior management on which bids to accept.

Investigations revealed that in early 1990s, Keppel Shipyard’s marketing manager first met Van der Horst in Holland to understand why Keppel had been unsuccessful in obtaining contracts with Petroleum Shipping. In 1991, they met again in Singapore together with another Keppel Shipyard senior executive. Subsequently in 1992, a contract was awarded to Keppel Shipyard by Petroleum Shipping. When the bill for the job was given, Van der Horst had objected to the amount and referenced an earlier conversation he had with the Keppel Shipyard executives. This information was then passed on to other Keppel Directors, who after discussing the matter, decided to give Van der Horst a cut of 1 per cent of the contract sum for all tenders awarded to Keppel Shipyard by Petroleum Shipping. From January 1992 to May 1995, a total of S$8,527,343.30 was remitted by Keppel Shipyard into Van der Horst’s bank accounts held in Singapore so that the latter would assist Keppel Shipyard in securing tenders for ship repair jobs with Petroleum Shipping Ltd. This included providing information about Keppel Shipyard’s competitors’ tenders, including the price and deadline to complete a job, to Keppel Shipyard.

On 22 December 1997, Keppel Shipyard, who was represented in Court by its financial controller, Wong Ngiam Jih, pleaded guilty to three charges of corruption, and the company was fined a total of S$300,000. 14 other charges against Keppel Shipyard were taken into consideration during sentencing. Van der Horst had also pleaded guilty to corruption charges in a Southampton court in 1996, and has been sentenced to three years’ imprisonment.

Getting Into Deep Water

Getax Ocean Trades Pte Ltd (Getax Ocean), a Singapore incorporated company, was the logistics arm of Getax Australia Pty Ltd (Getax Australia). The company was in charge of chartering and arranging vessels for Getax Australia’s phosphate shipments. Getax Australia’s core business at that time was the export of phosphates from Togo and Nauru, and the import of the same to India.

Investigations by the CPIB revealed that in January 2010, a Director at Getax Australia had contacted Ryke Solomon, a Member of Parliament of the Republic of Nauru, expressing his interest in advancing his company’s interest with the Republic of Nauru Phosphate Corporation. Solomon subsequently asked for at least USD$30,000 to fund his re-election campaign in Nauru. On 18 February 2010, the same Director directed a manager at Getax Ocean to transfer USD$20,000 from a Citibank account belonging to an agent of Getax Ocean to the personal bank account of Solomon.

Getax Ocean was charged on 28 July 2016 with one count of corruptly giving about USD$20,000 to Solomon as an inducement to advance the business interests of Getax Australia with the Republic of Nauru. On 28 June 2018, Getax Ocean Trades Pte Ltd was fined $80,000 for corruption.

Engineering An Illegal Transaction

Peh Chew Seng was the Deputy Director of Projects and Development at Tan

Tock Seng Hospital. He was in charge of the construction of a temporary

4-storey office next to the hospital’s main building.

Investigations by the CPIB found that sometime in early 2009, Peh had contacted his friend, Sim Geok Soon, an executive director of Trans Equatorial Engineering Pte Ltd about the construction project. Peh had asked Sim if his company would be keen to submit a tender for the project. Sim responded that another affiliated company, PBT Engineering Pte Ltd, was interested in the job. Through Sim, Peh was introduced to Phua Boon Kin, executive director of PBT Engineering Pte Ltd. Prior to meeting Phua, Peh had told Sim that if PBT Engineering was successful in tendering for the project, he expected something in return. Sim then informed Phua of Peh’s request for the commission, to which Phua agreed. Peh’s misdeeds eventually came to light when he contacted the building project consultant to disqualify the three lowest bids from running for the tender and to put PBT Engineering Pte Ltd through to the next round of assessment.

Peh Chew Seng was found guilty of corruption by the Court and was sentenced to six weeks imprisonment on 12 September 2012.

Brothers In Cahoots

Goh Peng Choy was a Senior Procurement Executive with Advanced Material Engineering Pte Ltd (AME), a wholly owned subsidiary of ST Kinetics Ltd. He had abused his position to obtain bribes from several contractors of AME in return for divulging AME’s internal price list which is confidential information or showing favour to the contractors. All the bribe monies were given in cash to Goh Peng Choy.

Goh Peng Choy had concealed the bribe monies with the assistance of his brother, Goh Peng Kee. The latter had hidden the cash in his residence. Goh Peng Choy had also instructed his brother and sister-in-law to open bank accounts to deposit part of bribe monies. S$385,000 was found in Goh Peng Kee’s safe. A further S$100,767.03 was recovered from the bank accounts.

Goh Peng Choy was subsequently charged for both corruption and money laundering offences. On 17 February 2014, he pleaded guilty to 4 corruption charges and one money laundering offence and was sentenced to 22 months’ imprisonment. The Judge also ordered him to pay a penalty of S$372,923 while S$12,077 was forfeited to the State. A total of S$485,767.03 was recovered.

Original Vessel, Pirated Parts

Teh Hang Peng was a Material Controller with the Singapore Technologies Logistics Pte Ltd (ST Log) and was based at the warehouse in Tuas Naval Base (TNB), Republic of Singapore Navy (RSN). His duties as a Material Controller were to check that the goods delivered to the Tuas Naval Base are of the correct description and quantity based on the Purchase Orders and Delivery Orders as required by the Republic of Singapore Navy. From January 2003 to July 2004, Teh was found to have obtained a total of S$9,300 in return for assisting Lim Teck Beng, then the manager of JP Marine (SEA) Pte Ltd, to supply locally fabricated marine spare parts to TNB and passing them off as imported originals.

The CPIB started investigating the case after it had received information. Its investigation revealed that Teh had given assistance to Lim in various ways. Teh had smuggled existing stock from the TNB warehouse and passed the parts to Lim. Lim subsequently brought these “samples” to the fabricators and fabricated similar ones that were disguised as those produced by the Original Equipment Manufacturers (OEM) before supplying to the RSN. He then checked the part numbers, origins and functions at the warehouse and subsequently passed the information to Lim. Teh had also removed packing labels and sticker from existing stock in the warehouse, together with the description on how the items were normally packed by the OEM overseas, and passed them over to Lim to reproduce. In addition, Teh had informed Lim of the work schedule of the Quality Assistance (QA) Inspectors. Lim needed the information as he would prefer to deliver the fabricated parts to the TNB warehouse at those times when the known meticulous QA Inspectors were off duty.

Teh Hang Peng was consequently fined S$60,000 and ordered to pay a penalty* of S$9,300 in November 2004 for corruption offences. Lim, on the other hand was fined S$72,000.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

A Slice Of Apple Pie Gone Bad

Chua Kim Guan was a Managing Director of Jin Li Mould Manufacturing Pte Ltd and was in charge of the operations in the company. Ang Kok Kiat was the Sales Director of the same company. The company is in the business of producing moulds and has had business dealings with Apple Inc since 2001.

The CPIB received information on the case and investigation had shown that between November 2006 to June 2009, the duo had worked together to give bribes to one Paul Shin Devine, a Global Supply Manager under the employment of Apple Inc. In return, Devine would provide information on Apple Inc’s upcoming projects such as product forecasts and pricing targets so that Jin Li Mould Manufacturing Pte Ltd could secure the contracts.

Chua had allegedly given a total of US$387,600 to Devine over a course of 2 years in Singapore, Macau, People’s Republic of China (PRC) and the United States of America (USA) to advance Jin Li Mould Manufacturing Pte Ltd’s business interests. Ang had abetted these transactions as well as those involving two other Singaporean companies, Fastening Technology Pte Ltd and Lateral Solutions Pte Ltd. Moreover, he had also received payments from the shareholders of the two companies, for aiding them to secure business contracts from Apple Inc through Devine. He also received from Devine for his assistance in the transactions with Jin Li Mould Manufacturing Pte Ltd, Fastening Technology Pte Ltd and Lateral Solutions Pte Ltd.

In December 2013, Chua Kim Guan was jailed for 9 months for giving bribes to Paul Shin Devine to advance his company’s business interests with Apple Inc. Ang Kok Kiat was sentenced to imprisonment of 12 months and ordered to pay a penalty* of S$281,985.51. Paul Shin Devine had pleaded guilty earlier in the US Federal Court in February 2011 to wire fraud, conspiracy and money laundering.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

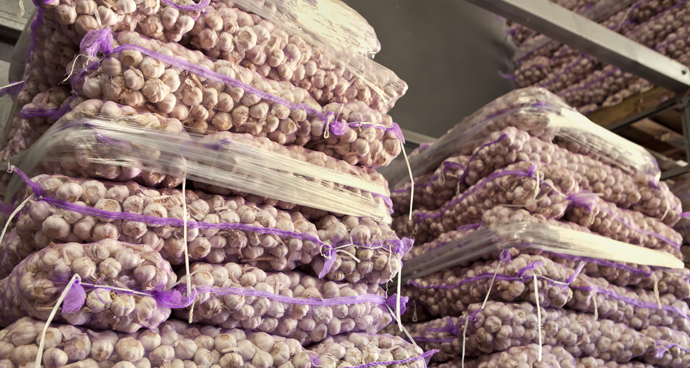

Bribes In Return For Food Supply Contracts

Leng Kah Poh was the IKEA Food Service Manager for Ikano Pte Ltd (IKEA Singapore). Being the top man in charge of IKEA Food Service, he had a free hand in making most of the decisions related to the restaurant operations including approving food suppliers to IKEA Singapore.

The CPIB received information on the case and its investigation revealed that sometime in 2002, Leng got acquainted with Lim Kim Seng, the sole proprietor of Buildcare Services who performed cleaning works for IKEA Singapore’s restaurants. The latter approached Leng with a business proposal to replace IKEA Singapore’s existing food supplier. He introduced Tee Fook Boon, the sole proprietor of AT35 to Leng. Subsequently, AT35 managed to take over the supply of raw food ingredients from IKEA Singapore’s existing supplier with the assistance and recommendation of Leng. Part of the company (AT35)’s profits went to Leng even though he did not contribute to the initial capital investment to finance their business scheme. Later, Lim set up Food Royale Trading (FRT) to supply chilled and dry food products to IKEA Singapore. AT35 and FRT then became the exclusive suppliers of frozen, chilled and dried food ingredients and products to IKEA Singapore. Leng continued to exercise his influence and favour the two companies. He would give insider information on how to make AT35’s and FRT’s products attractive to IKEA Singapore.

Over a period of about 7 years, through AT35 and FRT, Lim Kim Seng, Tee Fook Boon and Leng Kah Poh amassed for themselves S$6.9 million out of the company profits from the food supply contracts with IKEA Singapore. Leng took a one-third share for his pivotal role in their business scheme, in the amount of about S$2.3 million.

All 3 persons were charged and convicted for corruption offences. Leng Kah Poh was convicted by a District Court in July 2013 but was later acquitted in September 2013 by the High Court. The High Court decision was then overturned by the Court of Appeal in November 2014, which restored Leng’s original sentence of 98 weeks imprisonment and S$2,341,508 penalty* on the corrupt proceeds he received. Lim Kim Seng was convicted and sentenced to 70 weeks imprisonment in 2013. Tee Fook Boon was originally convicted by a District Court to 16 weeks imprisonment and fine of S$180,000. Subsequently, Tee’s imprisonment was enhanced to 40 weeks with the fine amount remaining unchanged on 22 August 2011.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

Fine Line Between Tradition And Corruption

Tay Ee Tiong is the owner of Wealthy Seafood Product and Enterprise. During his course of work, he had personally approached each head chef and promised them commissions in return for showing favour to Wealthy Seafood. Many of these chefs were from well-known Chinese restaurants and hotels in Singapore. These chefs were prominent and established, and had the authority to make decisions on the choice of suppliers for their respective restaurants.

The CPIB’s investigations found out that from February 2006 and August 2009, Tay had given bribes to 19 chefs ranging from S$200 and S$24,000. Tay would approach these chefs and promise them commissions, based on a percentage of the total value of the seafood products bought. The chefs would receive the cash from Tay once every two to three months. In return, they would continue to place their seafood orders from Tay’s company.

Tay Ee Tiong was eventually charged with 223 counts of corruption and sentenced to 18 months’ imprisonment in September 2011 for giving out nearly S$1 million in bribes. The chefs involved were also convicted with corruptly accepting bribes from Tay and received their respective sentences, with the exception of one who was acquitted.

Bunkering Deal Gone Awry

Antonov Sergey was the Chief Engineer of the vessel MT Front Splendour while Choo Soo Beng was a Cargo Officer with Sea Hub Energy Pte Ltd assigned to the bunker barge MT Ivory. These individuals ensured that MT Ivory delivered a shortfall of marine fuel to the vessel - MT Front Splendor. The vessel had received less fuel than the amount of 2,662.389 metric tonnes as stated in the documents. The intent of this endeavour was to enable the buying back of the extra fuel. Sergey’s ship, the MT Front Splendour, had ordered marine fuel from supplier Sea Hub Energy to be supplied on 20 January 2013. However, Choo had struck a deal with Sergey to accept a short delivery of marine fuel in return for a bribe of US$8,400.

Lam Tat Fei, colleague of Choo and a boatman under the employment of Sea Hub Energy, received US$200 from Choo for his part in the transaction. Lam was responsible for obtaining confirmation to proceed with the deal, and for delivering the amount of US$18,000 to pay for the extra fuel resulting from the shortfall. An independent bunker surveyor working for Saybolt Singapore Pte Ltd, Loh Tuck Seng, was also bribed to provide false declaration that 2,662.389 tonnes of fuel had been received by MT Front Splendour from MT Ivory, instead of the actual 2,542 tonnes delivered. Loh received US$400 and US$5,500 from Sergey and Choo respectively. To account for the extra fuel on board MT Ivory, Choo falsified a barge transfer advice and the stock movement logbook to indicate a bogus transfer of fuel from another vessel, MT Hai Soon X, to the MT Ivory.

The CPIB started its investigation after it had received information on the case.

The four men were charged for their part in the illegal “buyback” transaction which constituted a corruption offence. Antonov Sergey was sentenced to 2 weeks’ jail, fined S$30,000 and ordered by the Court to pay a penalty* of US$6,750 which was the amount not recovered. Choo Soo Beng was jailed for 8 weeks while Loh Tuck Seng was jailed for 2 weeks and fined S$25,000. Lam Tat Fei was sentenced to 6 weeks in prison and ordered to pay a penalty* of US$200. The amounts of US$3,900, US$5,900 and US$1,250 were seized from Choo Soo Beng, Loh Tuck Seng and Antonov Sergey respectively and these were forfeited to the state.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

Men Of The Match

Kim Jae Hong and Jeon Byung Euk are Korean Nationals and professional football players who came to Singapore to play in the S-League. Both men were former players of the Geylang United Football Club (GUFC).

On 10 April 2012, GUFC goalkeeper Mohamed Yazid Mohamed Yasin received a call from an unidentified foreign number. The male caller, who sounded Korean, asked Yazid if he was willing to fix the results of matches he would be playing in. In return, Yazid would receive between S$4,000 and S$7,000. Kim met Yazid on 2 May 2013 where he gave Yazid S$4,000 as an inducement to ensure that the GUFC lost its match against Harimau Muda A Football Club that was to be played on 3 May 2012. Another S$4,000 was given to Yazid to be passed to another football player of GUFC to fix the same S-League football match. Yazid rejected the bribe offer. Subsequently, the CPIB was alerted and investigated the case.

Kim had also engaged in conspiracy with Jeon to approach another GUFC player, Mun Seung Man, to fix the same game on 3 May 2012. Jeon met up with Mun on 2 May 2012 where he told Mun that he should refrain from scoring any goals during the match. If Mun agreed to the deal, he would receive between S$3,000 and S$4,000.

Kim Jae Hong and Jeon Byung Euk were both charged for match-fixing and pleaded guilty to their offences in May 2012. Jeon Byung Euk was sentenced to 5 months in prison, while Kim Jae Hong was jailed 10 months.

Illegal Commissions For Facilitating Loans

Wong Teck Long was former Senior Vice-President (Private Banking) of Bayerische Landesbank Girozentrale (BLG). Part of his duties at BLG was to source for private individuals in the Asia Pacific region who wished to borrow money for investments.

The CPIB had received information on the case. Its investigation revealed that Wong was introduced to Kong Kok Keong who was then Executive Director of Innosabah Sdn Bhd (Innosabah), a share broking company located in Sabah, Malaysia. Kong had intended to obtain credit facility from BLG to purchase shares. Subsequently, in April 1997, Wong put up a Credit Approval to the management of BLG recommending to grant Kong a Revolving Short-Term Multi-Currency Loan of RM14.5 million. The management approved the loan application. Kong, besides obtaining the loan from BLG for himself, also got his nominees from Malaysia to apply for the loans. Nine Malaysians managed to obtain Revolving Short-Term Multi-Currency Loan of RM14.5 million each from BLG through Wong.

For expediting the approval and drawdown of the loans, Wong demanded a substantial commission from Kong. The commission was given to Wong in the form of shares traded in Wong’s nominee share account with Innosabah. Wong would purchase the shares but the shares would be paid by Kong. In total, Wong had received from Kong about RM 300,000 to RM 400,000 which were the proceeds from the sales of shares.

In February 2005, Wong Teck Long was sentenced to 4 months imprisonment and ordered to pay a penalty* of S$150,000 for corruption offences. In June 2005, Wong appealed against the sentence without success. Instead, his sentence was increased from 4 months to 15 months imprisonment. The penalty sum remained at S$150,000.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

Airport Manager Bagged For Corruption

Abdul Rahim Bin Jumaat was employed as a Duty Terminal Manager at the Baggage Department of the Singapore Airport Terminal Services Limited (SATS). His responsibilities included overseeing the daily loading and unloading operation of passenger baggage for incoming and outgoing flights from Changi Airport Terminal 2.

The CPIB started an investigation on the case after it had received information. Between 6 November 2007 and 29 April 2008, Rahim had accepted gratifications totalling S$5,080 from one Abdul Falik Bin Abdul Latiff, a freelance airport agent in return for confidential information of passengers with no check-in baggage. Falik had used the information to help his clients who are foreign passengers with excess baggage. The excess baggage were then included under the quota meant for those passengers without any check-in baggage so that Falik’s clients did not have to pay the excess baggage charges.

Rahim had made unauthorized access into the Kris Check system (used at Changi Airport) on 25 occasions from 5 November 2007 to 25 April 2008, to obtain the names and information of passengers (with no check-in baggage) for Falik. Falik would get paid for providing this service and he, in turn, would pay Rahim for providing him with the list of passenger names.

Both men were charged and convicted for corruption. Rahim was also charged under the Computer Misuse and Cyber Security Act. On 30 November 2012, Abdul Falik Bin Abdul Latiff was sentenced to 2 weeks imprisonment and S$12,000 fine while Abdul Rahim Bin Jumaat was convicted on 21 May 2012 and sentenced to 2 weeks imprisonment, S$36,000 in fine and a penalty* of S$5,080.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

A Negotiation Deal Went Wrong

As a supplier quality engineer, one of Nagvekar Samir Kishor’s responsibilities was to conduct price review negotiations between his company, Reservoir Product Manufacturing (S) Pte Ltd, and its suppliers.

In April 2013, Samir was introduced to Sean Tan, Business Development Director of Telford Industry Co. Ltd to discuss on a regular price review as required in their contract agreement. After the meeting, Samir informed Tan that he could help to postpone the price review to a later date if Tan could help him on a personal matter. At that juncture, Tan understood that Samir wanted something from him in return for delaying the price review by three months. Samir added that he was in urgent need of money and he needed S$15,000. Tan rejected Samir’s repeated requests for the bribe on several occasions. Eventually, a police report was made and the matter was then referred to the CPIB.

Nagvekar Samir Kishor was charged and fined S$15,000 on 17 Dec 2013 for corruption offences.

A Little Coffee Money “Did No Harm”

Sheith Yusof Bin Sheith Ibrahim was a trainer of Absolute Kinectics Consultancy Pte Ltd where he coached trainees attending the welding course on the theoretical and practical aspects of welding. In addition, his duties also included assisting the external welding testers during the welding test. Any trainee who passed the test would receive a welder pass which is recognized by the Ministry of Manpower.

Investigation by the CPIB revealed that from November 2012 to March 2013, he took advantage of his position as a trainer to obtain bribes from course trainees on several occasions. These bribe amounts which ranged from S$5 to S$50 were given in return for showing leniency during the welding courses and tests.

Sheith Yusof Bin Sheith Ibrahim admitted that he had obtained money from his trainees during the two courses conducted in 2012. In January 2014, Yusof was fined S$8,000 and a penalty* of S$199 for the corruption offences. The 11 foreign workers who gave the bribes were given conditional warnings.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

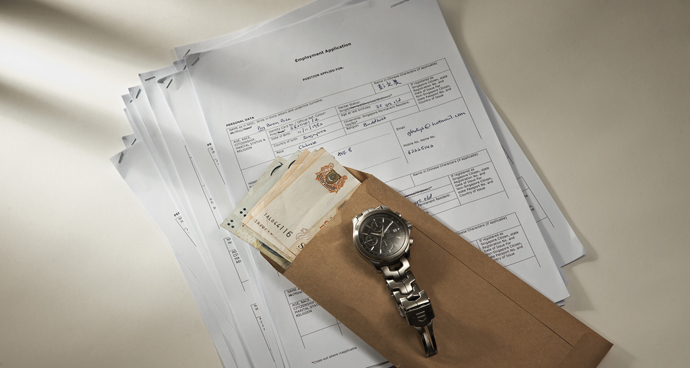

Too Late To Turn Back Time

Singleton Marc Alexander was the former Managing Director of Performance Motors Ltd. As Managing Director, part of his responsibilities was to review the yearly renewal of authorised dealership granted to local companies for the distribution and sales for BMW cars in Singapore. He also had the authority to approve or terminate dealerships.

The CPIB had received information on the case. Its investigation revealed that on 17 December 1999, Alexander received two Rolex watches from Teo Kian Hong, a Director of Teo Tian Seng Motor Credit Pte Ltd (TTS), as a Christmas present. In return, Teo had hoped that Alexander would continue to appoint TTS as one of the dealers for distributing BMW cars. Subsequently, Alexander had approached Teo with requests to buy more branded watches. On some occasions, Alexander would make a payment to Teo for the branded watches at a discounted price. But most of the time, Alexander would not pay back Teo for the branded watches. Teo did not seek payment from Alexander as she wanted TTS to continue to be an authorized dealer for BMW cars. The branded watches had a total worth of more than S$100,000. Alexander also obtained from Teo, 3 Nokia handphones and a sum of S$78,000.

Besides Alexander, Teo had also given bribes to Patrick Pow, the Director of Sales and Marketing at Performance Motors Ltd. In his position, Pow could recommend for renewal or termination of dealer agreements. Teo had given Pow a Hermes watch as a Christmas gift. Despite Pow knowing it was against company policy, he accepted the gift. From December 2000 to December 2002, Pow obtained from Teo branded watches with a total worth of S$4,165, a Nokia handphone worth S$1,388 and a loan of S$60,000.

Further investigation revealed that Pow has also obtained bribes from Kheh Thiam Hoo, Director of Skyway Credit & Leasing Pte Ltd (Performance Motors Ltd’s appointed sole finance agent), in return for the maintenance of a good business relationship with Skyway. Pow had received from Kheh, a Frank Muller watch worth S$13,390 for his birthday and loans amounting to S$82,000.

Marc Alexander was charged with corruptly obtaining gratification from Teo as an inducement to continue Teo’s dealership. He was fined S$185,000 and ordered to pay a penalty* of S$112,142 on 27 October 2005. Patrick Pow was charged with corruptly obtaining gratification from Teo Kian Hong and Kheh Thiam Hoo as an inducement to re-appoint their companies as dealers of Performance Motors Ltd. On 18 April 2005, he was fined S$120,000 and ordered to pay a penalty* of S$142,000.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

Breach Of Trust

Sazaly Bin Selamat is a former bank executive at the Development Bank of Singapore (DBS) in the Technical & Operations Department. His main duties included the clearing of cheques from customers for payment of credit card or cash line bills.

Sometime in 2005, Sazaly met Alex Lian, a car repossesser when Sazaly’s car was repossessed due to non-payments of his car instalments. Subsequently, Alex came to know Sazaly was employed at DBS and he was able to access DBS’s customer database. Alex called Sazaly up a few days later and asked if he would like to make some money by helping him obtain the particulars of DBS’s customers through the database. Alex informed other individuals known to him about Sazaly’s “services” and the latter provided the required information to them in return for cash. From July 2005 to October 2006, Sazaly provided DBS customers’ information to Alex and his contacts, which included illegal bookies and loan sharks.

On 28 January 2011, Sazaly Bin Selamat was sentenced to 12 weeks’ imprisonment and ordered to pay a fine of S$21,000 and a penalty* of S$2,625 for corruption offences. He was also fined $6,000 for computer misuse offences.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

Concealed Act Uncovered

Lo Keng Foo was the Director of the Failure Analysis and Reliability Engineering Section at Chartered Semiconductor Manufacturing Pte Ltd (CSM). His job scope involved studying and acquiring new technologically advanced test devices to measure the reliability of semiconductor products manufactured by CSM.

The CPIB acted on information received and investigated the case. In 1994, Lo got to know Lim Cheng Hock, Chairman of Zen Voce Manufacturing Pte Ltd, after he became a supplier of CSM for Test Solution Products. Sometime in 1997, Lo had a discussion with Lim Cheng Hock. Lo said he could help Zen Voce secured sales orders from CSM in return for a cut of their profits. From March 1998 to August 2002, Lo obtained S$1,017,343 from Lim as a reward for helping Zen Voce. Subsequently from August 1997 to July 2000, Lo obtained S$211,400 from Chng Peng Hion, Managing Director of ESA Electronics Pte Ltd (ESA), as a reward for helping ESA secured contracts with CSM. To camouflage the accounts of Zen Voce and ESA and cover these illicit payments, Lo created fictitious invoices to mislead Zen Voce and ESA.

On 24 January 2006, Lo Keng Foo was sentenced to 4 years’ imprisonment and ordered to pay a penalty* of S$1,228,743 for corruption offences.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.

An Unlawful Helping Hand

Chew Gay Kian was the Purchasing Superintendent of ST Microelectronics Pte Ltd (STM). His job scope included creating vendor accounts, issuing purchase orders to vendors and updating the information in the computer system.

The CPIB’s investigation revealed that Chew first met John Ee, a Director at Iconium Technologies Pte Ltd, in March 2005 during a meeting where Ee was seeking for Iconium Technologies to be appointed as a vendor to supply products to STM. During the time when Chew was preparing to create a vendor account for Iconium Technologies, he approached Ee for a loan of S$6,000. Ee agreed to give the loan to Chew as he needed Chew’s help in qualifying Iconium Technologies as a vendor for STM. After Iconium Technologies was approved as a vendor for STM and started business dealings with them, Ee became aware of Chew’s financial difficulties. Although Ee refused to loan Chew any money, he helped to pay for expenses incurred by Chew for dining, entertainment and repair bills. Ee also gave a red packet to Chew’s daughter as a birthday gift.

Chew Gay Kian was charged for corruptly obtaining gratification in the form of loan and gifts amounting to S$8,650. In July 2010, he was fined S$29,000 and ordered by the Court to pay a penalty* of S$8,650.

* Penalty is an additional punishment (for corruption offences) imposed on the bribe taker to pay a sum which is equal to the amount of that gratification.